By Rebecca A. Shafer – August 2011

|

Limiting workers compensation claims costs requires finding and filling gaps within the process. To do so, you must work closely with your claims administrator. Here are three ways to cut costs.

#1. Arrange a Chairside Visit

A chairside visit, in which the employer representative sits down with an inside adjuster, is a quick way to see how claims are handled. Once at the adjuster’s office, a manager should ask who touches the claim first so she can sit by that person to view the intake process. Ask whether other employers use more aggressive processes and consider whether any changes are merited. With some administrators, medical-only claims and lost-time claims are handled by different adjusters. If that is the case, observe both. Also important to ask is what documentation employees use to verify their medical condition and when that documentation is received.

The manager may be surprised. During one chairside visit, a risk management consultant saw a disability slip stating “no work for four months.” But there was no diagnosis, no prognosis, no treatment plan and no information that was useful to plan a transitional-duty job to get the employee back to work. In response, the risk manager created a more detailed form that all employees were to return when reporting workplace injuries. Had the consultant not seen that tiny, incomplete form scanned into the adjuster’s notes, she and the risk manager never would have known that cost-control problems began with a lack of documentation.

In another recent chairside visit, a consultant asked what the next step was with the claim, and the adjuster replied that the claim was scheduled for a “med-legal.” Neither the risk manager nor the consultant had ever heard of a med-legal, which is a very important meeting between the employer’s attorney and the employee’s treating doctor. Today, the risk manager is notified of all med-legal meetings.

#2. Arrange a Vendor Day

There is almost no end to the range of benefits offered by claims administrators. Services can include nurse triage, telephonic case management, physician review, life-care planning, mental health programs, wellness programs and bill audit to name just a few.

Some of these services are owned by the administrator while others are affiliated with the administrator. Because some affiliated services may be private-labeled, bearing the name of the third party administrator, ownership may not be transparent. Even though claim administrators own or affiliate with various services, in many cases an employer can still use independent services. This is called “unbundling” and is allowed by claim administrators that are able to customize claim-handling services, particularly when a company has a high deductible.

The manager should ask the broker or claims account executive to set up a vendor day and prepare an agenda. Vendors should share their suggestions about integrating services and discuss techniques used by other employers.

Many organizations are not satisfied with their claims administration services. They believe that ancillary services are inadequate or that helpful services are not being offered. The vendor day is a formal meeting with service providers to determine if that is true or not. Invite every provider to bring samples or reports. A knowledgeable representative should explain the service, differentiate it from competitors and brainstorm as to how it might fit into the program.

#3. Clarify Account Instructions

Account instructions are the directions specifying how the administrator will handle claims. It is a crucial document, so it is important to choose the wording carefully, as seemingly minor differences in wording can have a dramatic effect. For example, there is a world of difference between an employer having settlement “authority” and settlement “consultation.”

Instructions should be complete, accurate and reflect any special process. Explain to the administrator that your company is implementing a cost-control program and seek suggestions. The account instructions should include the name and phone number of the contact person at the network.

For example, in the case of a med-legal visit for physical therapy, the instructions might read: “Use of Physician Review Services: Upon receipt of notification of med-legal meetings, immediately schedule physician review services. Have the physician review the claim and discuss the medical aspects of the injury with defense counsel. Provide contact information to physician and counsel. Send a copy of any medical review notes

to the adjuster and employer.”

Rebecca A. Shafer, of Amaxx Risk Solutions, is a consultant and attorney who runs LowerWC.com, which covers developments in the workers comp field.

Reprinted with permission from Risk Management Magazine. Copyright 2011 Risk and Insurance Management Society, Inc. All rights reserved.

Find more ideas and assistance at:

- RIMS: The Risk & Insurance Management Society – a Workers Comp Resource Center Partner

- Reduce Wasteful Workers’ Comp Practices

- “Sales to Pay for Accidents” Calculator

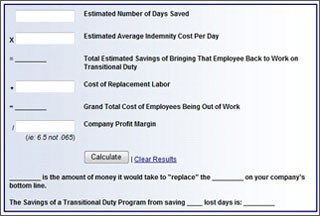

- Free Transitional Duty Cost Calculator

- Workers’ Comp 101

Maximize Insurance Claim Results

Maximize Insurance Claim Results